Out like a lion!

Getting back into the swing of things with another post this week! Whoo!

Trying to find some good FI blogs. Still have some of my favorites (see the sidebar to the right), but always looking to feed that hunger for more!

As a reminder to you, our readers, our goals for our financial journey:

Trying to find some good FI blogs. Still have some of my favorites (see the sidebar to the right), but always looking to feed that hunger for more!

As a reminder to you, our readers, our goals for our financial journey:

Goals.

Our immediate goals are simple:

- Pay down our $12,000 in credit card debt. We're now down to $9,605. So, we've paid off (including extra interest payments) almost $3,000 in three months. The majority of that being in March.

- Increase our Emergency Savings from $100 to $1000. Longer term, we'd like to increase this to 6 months of our salaries. We've put this goal on the back burner for now in order to pay off debt more quickly.

- Save for our vacation in November ($1000-$1500). We had the money set aside for this. We put it toward paying off the debt up front now, so we can reduce the amount of interest we're paying. We know that we can set aside roughly the $120/month for our vacation in November.

- Save for a possible down payment on a new car ($2000-$2500). I think we're at the point where we're comfortable pushing this goal out until next year, so that will help our financial goals.

It's good to see that we're making progress on the biggest goal (debt repayment), but at the same time, it's frustrating to see a lack of progress on our other goals. In reality, we're putting all goals off in order to pay down our debt.

Well, at the very least, let's see how we did.

Well, at the very least, let's see how we did.

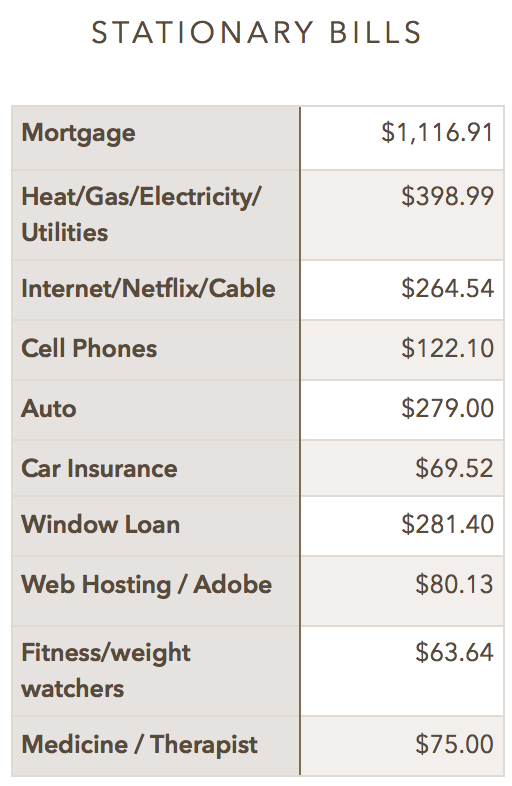

Mortgage: $1,116.91

Back to our normal mortgage payments this month. I also included a couple small house-related payments here - home improvement type stuff. Nothing out of the ordinary here!

Heat/Gas/Electricity/Utilities: $398.99

Gas - $89

Electricity - $103

Gas - $92

Water/Trash - $114

I put the breakdown for this category because it was almost twice as much as February. Two reasons. 1, we paid our bi-monthly city municipal bill which includes our water bill and trash bill. The second reason it was higher was that we paid our April gas bill a couple days early, and I continued to keep it in the budget for March to reflect when the money was actually taken out of our account.

Electricity - $103

Gas - $92

Water/Trash - $114

I put the breakdown for this category because it was almost twice as much as February. Two reasons. 1, we paid our bi-monthly city municipal bill which includes our water bill and trash bill. The second reason it was higher was that we paid our April gas bill a couple days early, and I continued to keep it in the budget for March to reflect when the money was actually taken out of our account.

Internet/Netflix/Cable: $264.54

DirecTV - $102

DirecTV - $107

Internet - $55

Netflix - $8

Like the utilities category, we paid ahead on our DirecTV bill. Kept it in the budget for March to reflect when it was actually paid.

DirecTV - $107

Internet - $55

Netflix - $8

Like the utilities category, we paid ahead on our DirecTV bill. Kept it in the budget for March to reflect when it was actually paid.

Cell Phones: $122.10

Since February, we've had a lower Verizon bill because of the changes I made in January.

Auto: $279

Back to the normal auto loan payment. Boo!

Car Insurance: $73.59

Back on track on this one.

Window Loan: $281.40

No change here.

Web Hosting / Adobe: $80.13

Bought a new domain and one month of hosting, in addition to normal expenses.

Fitness: $63.64

Weight Watchers. Registration for Half-Marathon in June.

Medicine / Therapist: $75

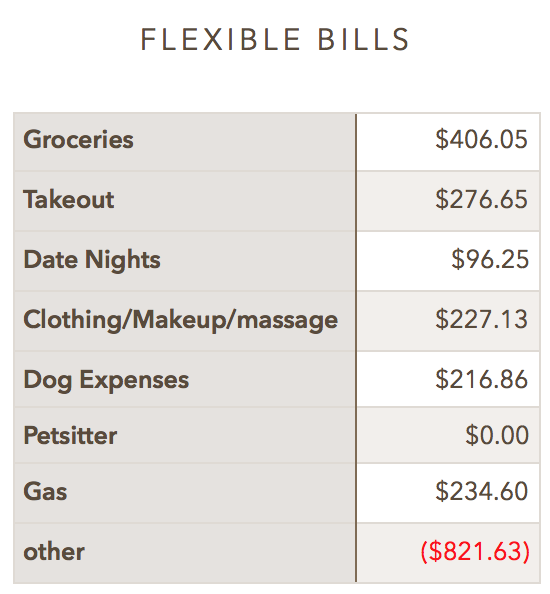

Groceries: $406.05

Seems to be our normal area. We actually budgeted for $400 here, so this was spot on where we wanted to be.

Takeout: $276.65

Less than February by about $10. More than our $200 budget, though!

Date Nights: $96.25

Less than our budget by $24.

Clothing / Makeup / massage: $227.13

Mrs. Corn Fed bought some new spring clothes, and has also been losing weight (due to Weight Watchers), so needed better fitting clothes! A good problem for us to have!

Dog Expenses: $216.86

Normal vet visit for the puppy and a couple bags of dog food. Also includes new treats and some new toys - puppies go through toys quickly!

Gas: $234.60

Had some longer weekend trips this month, so we had larger gas bills.

Other: -$821.63

What?

What this actually means is that we gained $821.63 in the "other" category this month. How did we do that? It's basically our tax refund. We applied this to our credit card, so it was basically a wash, as you'll see in the next segment.

What this actually means is that we gained $821.63 in the "other" category this month. How did we do that? It's basically our tax refund. We applied this to our credit card, so it was basically a wash, as you'll see in the next segment.

As you can see, we've basically removed any savings. For better or for worse. But due to a combination of reducing our spending, our tax refund, and some extra cash, we put almost $1900 towards our credit card this month! Whoo!

Like I said in the previous write-up, "Our priority, right or wrong, is paying down the credit card as fast as possible."

Like I said in the previous write-up, "Our priority, right or wrong, is paying down the credit card as fast as possible."

So how did we do overall?

This is a little skewed because of how much we put towards the credit card this month. We put more towards the credit card than we actually pulled in, hence the difference in the overall monthly budget.

I looked at Mint to see if we're on the right track. So far for the year, Mint is pretty accurate with a positive cash flow of $1865 for the first quarter of the year. That accurately portrays how we've been able to contribute so much to our credit card debt in the first three months!

I looked at Mint to see if we're on the right track. So far for the year, Mint is pretty accurate with a positive cash flow of $1865 for the first quarter of the year. That accurately portrays how we've been able to contribute so much to our credit card debt in the first three months!

Frugalwoods Method of Non-Mortgage Spending.

March - $4,155.23

February - $3,924.79

January - $3,538.65

February - $3,924.79

January - $3,538.65

A bit higher than February. We obviously contributed much more to our credit card debt, but on the other side, we had a full mortgage payment this month. So, overall, we did spend quite a bit more than we have the past two months.